The Numbers

Average Sales For All Locations Open In 2022

Breakout Concept and Leader In The Category

Premium price points and no sushi chef required

Real estate, construction, marketing and operations

According to the Sushi Restaurant industry report conducted by IBIS World and published in March of 2023, Japanese cuisine interest heightened after Japan hosted the 2020 Olympics in Tokyo. Per capita disposable income and seafood consumption is projected to remain high, bolstering revenue. Over the next five years, industry revenue is expected to grow at a CAGR of 1.5% to $30.6 billion. Per capita income and seafood consumption will remain high bolstering revenue. Since sushi is often considered a healthy food, increases in the healthy eating index in 2023 signals potentially higher demand for sushi restaurants. Rising health consciousness directly affects sushi restaurants as US consumers become increasingly concerned about fat, fried, and salt, especially when dining out. Accordingly, sushi has become a popular alternative to transitional US dining options.

Source: Sushi Restaurants IBISWorld.com, Mar.2023

ALCOHOL OFFERS SOME OF

THE HIGHEST MARGINS IN THE INDUSTRY

Rock N Roll Sushi is aggressively focused on increasing alcohol sales. Together with Arkansas-based Origami Sake, its testing two RNR branded premium sakes to further differentiate the brand from other sushi restaurant’s sake offerings. Extensive bar and happy hour menu testing are occurring in markets around the country and menus include a variety of unique “Rocktails” options designed to encourage trade up from the more traditional beer, sake and wine offerings. Following the successful culmination of these test initiatives, a national bar and happy hour menu launch is planned for 2024. Pending the outcome of the branded sake testing, the plan is to make bottles of the exclusive Rock N Roll branded sake available at retail grocery locations in Rock N Roll Sushi trade areas around the US.

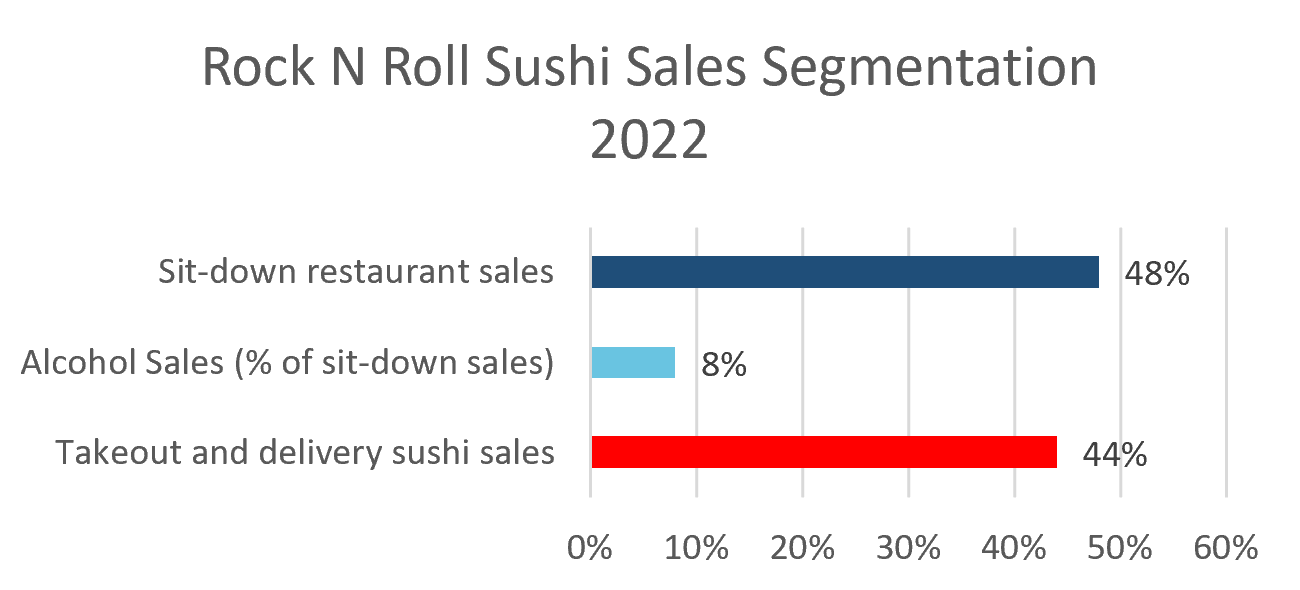

STRONG OFF-PREMISE AND TO-GO SALES

In 2022, Rock N Roll Sushi sales broke out to 48% sit-down, 8% alcohol (as a % of sit-down sales) and 44% attributed to takeout and delivery sales. A strong focus on increasing catering sales began in 2023 and is generating strong growth with an average order total of $467 and an average headcount per order of 23. Rock N Roll Sushi partners with ezCater which allows it to target a broader group of catering purchasers including pharmaceutical representatives who as a group spend considerable amounts on catering on behalf of their medical clients. Catering also provides Rock N Roll Sushi the opportunity to drive trial among potential new customers who are potentially trying the brand for the first time as a result of a catering order.

The estimated initial investment costs range from $232,000 - $675,000.

Financial ability to open a minimum of 3 locations.

Please refer to Item 7 of our Franchise Disclosure Document (FDD) for more details.

YOY Sale Change Source: Technomic Future 50 2023.